NeighborWorks Northeastern Pennsylvania has been helping families stay in their homes and find affordable solutions for over 40 years. When the foreclosure crisis first began, we worked tirelessly to ensure NEPA homeowners were given every available opportunity to stay in their homes. We continued this work through the COVID-19 pandemic and now NeighborWorks operates in multiple counties throughout Northeastern Pennsylvania.

Please contact our office to learn what services and resources are available to you.

Know Your Options

During this difficult time, many individuals are experiencing financial stress and are seeking information about how to navigate their options. Several lenders offer options to assist their borrowers and NeighborWorks is here to help. We have compiled the following resources.

To learn more about your specific loan, click the links below:

What if I don’t know the type of mortgage I have?

That’s okay. Many people are unsure who their mortgagor is. Fortunately, many mortgagors offer similar options. A housing counselor can assist to identify your loan type and terms.

You can also contact your servicer (the person you send your payments to) to find out what type of loan you have.

To learn more about your options, take our free online foreclosure course.

Act 91 Notice

Certain mortgages are eligible to apply to Pennsylvania State for the Homeowners' Emergency Mortgage Assistance Program. This program is a repayable hardship loan that you can only apply to through an approved housing counseling agency like NeighborWorks. If you receive a notice it is important to respond quickly because timely submission of the application stops your lender from filing in foreclosure court against you. However, by receiving this notice you can apply for the loan at any time but untimely submission does not stop the lender from filing in court.

Click here to learn more about this loan.

If you have not received an Act 91 notice, that is ok. That means this loan is not an option for you. Contact NeighborWorks to discuss alternative solutions.

What is forbearance?

It is important to understand what forbearance means and how a forbearance affects your mortgage.

- If you can make your mortgage payments, you should continue to do so.

- You must contact your loan servicer (the company you send your mortgage payments to) to find out if you are eligible for a forbearance.

- A forbearance does not guarantee you do not have to pay your mortgage, instead you may be approved to make a reduced payment.

- Though forbearance can last up to 12 months, in most cases they are approved for shorter periods of time. You must contact your lender to request the forbearance to continue.

- The forbearance terms can change when you request to extend it, and the payment may change from no payment to a reduced payment.

- Forbearances can result in a balloon payment at the end of your loan. A balloon payment is a large sum of money that is due at the end of your loan term, in full. The longer your forbearance period the more your balance will grow, resulting in a larger amount you will have to pay back.

If I receive a forbearance, do I have to repay my skipped payments?

Yes, you must pay the money back. In some cases, you will have to pay the balance from your missed payments at the end of the forbearance period. Each month you are adding to the balance of money you owe the lender. At the end of your forbearance period, the housing counselor will work with you to access your lender's options to resolve the balance.

Why apply for a forbearance?

If you are still in a financial hardship and struggling to make your mortgage payments, forbearance can help you remain in your home.

A forbearance is your lender giving you permission to miss your mortgage payments. But the payments are still missed, you could be charged fees and your lender may report missed payments to credit bureaus. The benefit to being in a forbearance while in a financial hardship is your lender has agreed to allow you to miss payments and in return, they will not initiate foreclosure proceedings against you.

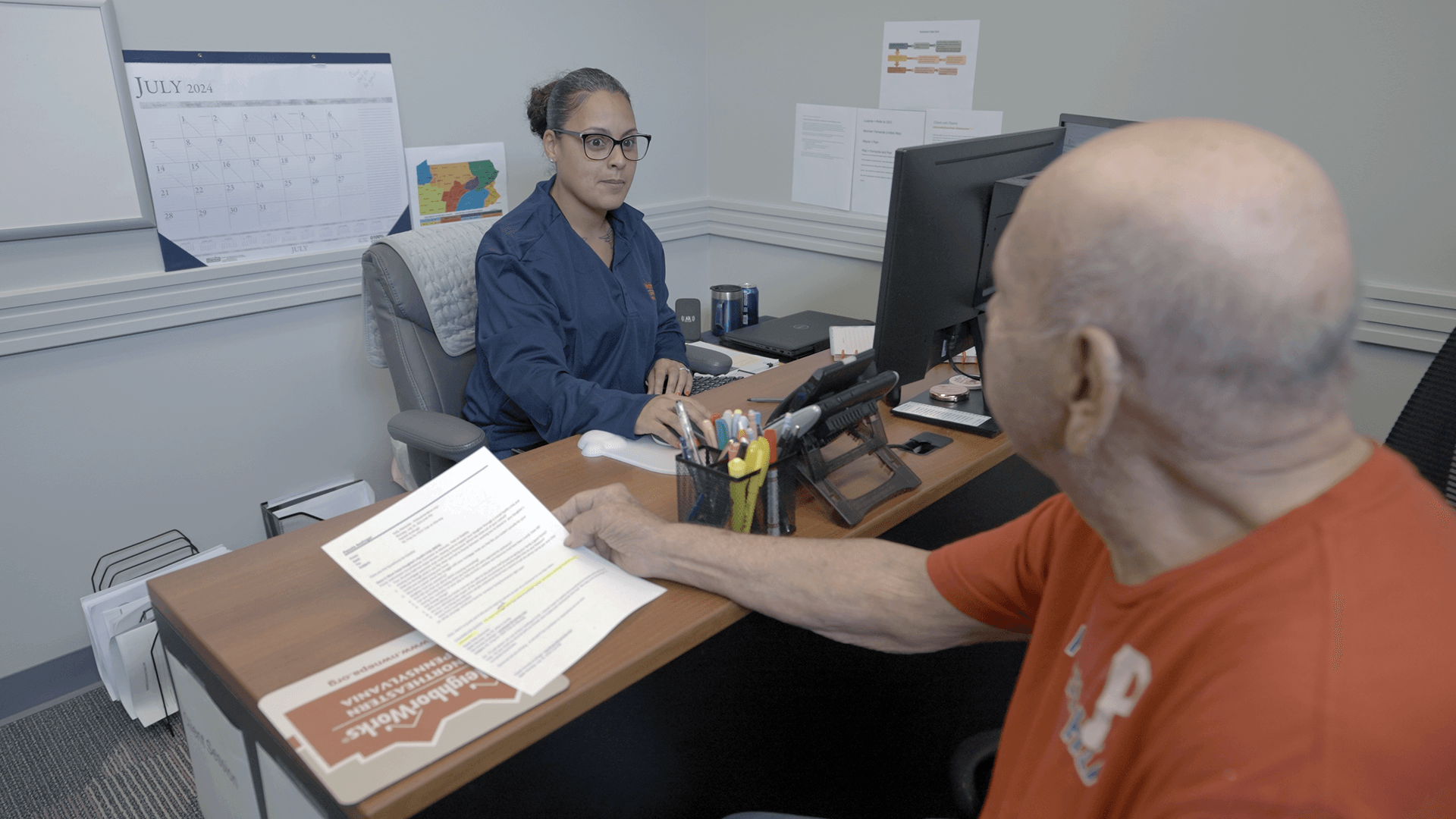

Work with a NeighborWorks Housing Counselor

If you need assistance with understanding your loan, what options are available to you, or applying for these options, contact NeighborWorks to schedule a meeting with a HUD-Certified Housing Counselor.

Our foreclosure intervention services include:

- A clear understanding of the foreclosure process in Pennsylvania

- Evaluation of loss and retention options

- A personalized review of your household budget and ways to reduce household expenses

- Completion of applications for eligible programs

- Entry into court protection programs which delay foreclosure where available

- Your assigned counselor is your court advocate and attends the court protection programs on your behalf

- Your counselor will work between you, your lender and your lender's attorney to access the programs which will help you stay in your home

Foreclosure Intervention Services Process

After you have initiated contact with our office:

- Complete the intake documents

- Take our free online foreclosure course

- Send your necessary documents

- Attend your scheduled appointment with a Housing Counselor to create your customized path

Know your documents

For a servicer to evaluate you for any options, they will need to review your current financials. Your HUD-Certified Housing Counselor will conduct an initial review of your documents, compile applications and submit to your lender on your behalf. These applications require a lot of documentation. Just like when you purchased your home, you worked with someone who assisted to apply for your mortgage. Your HUD-Certified Housing Counselor will be this resource to help keep you in your home.

Some documentation will be required prior to scheduling your appointment:

- Mortgage statement.

- Bank statements.

- Proof of current income, unless you are still in a financial hardship.

- Property tax and home insurance information.

- Proof of identity.

- Please keep in mind that everyone's situation is unique and other documentation may be needed.

Powered by Partnerships

NeighborWorks Northeastern Pennsylvania strives to provide the best quality services to every client. We have partnered with North Penn Legal Services to offer free legal advice to NeighborWorks clients in foreclosure. Additionally, any client who qualifies for North Penn Legal Services may be provided representation for the diversion program. For more information, visit North Penn Legal Services' website.